BEHIND THE DOOR OF THE WALMART BOARD, WAS THE REAL STORY DIFFERENT?

- Juan Carlos Erdozain Rivera, MBA

- Aug 8

- 6 min read

What Walmart's Leadership Teaches Us About Strategy and Execution

Why does a CEO fall when sales are growing? The answer is a brutal lesson in what's really discussed on a boardroom floor.

This isn't just a single mistake, but a deadly trend: the silent erosion of margins and the uncontrolled rise of expenses. The Superama case was just the first symptom.

This analysis exposes the full diagnosis, the warning signs that were ignored, and the key hidden in the numbers that precipitated the decision. A must-read for deciphering the true health of a business, beyond sales.

SENIOR MANAGEMENT BOARDS AND THE UNUSUAL CASE OF WALMART

In senior management circles, we rarely face events as revealing as the sudden change of a CEO at one of the country's largest corporations. The recent departure of Ignacio Caride from Walmart of Mexico and Central America is not a mere note on the business page; it's a symptom, an echo of past strategic decisions, and an invaluable lesson about the fragile balance between innovation and the impeccable execution of the core business.

As board members, our job is to read beyond corporate communications. When a resignation is announced for "personal reasons" after a 10% drop in net income despite an increase in sales, our experience tells us that the boardroom conversation went much deeper. It pointed to a fundamental truth of retail: sales are vanity, margin is sanity. Growth that doesn't translate into profitability is unsustainable and often a sign that strategy is becoming disconnected from sales floor operations.

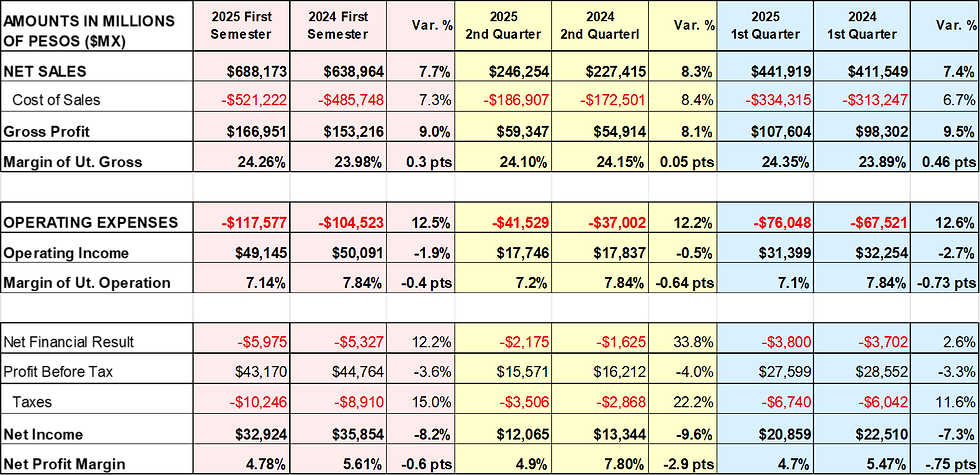

To understand this situation, I obtained the official financial reports issued by Walmex to the Mexican Stock Exchange (BMV); with this information, I prepared a consolidated income statement comparing the second half of 2025 and the first half of 2024 with the same periods.

Strategic Analysis of the Results

Sustained Sales Growth: The company maintains robust revenue growth (+8.3% in the quarter and +7.7% in the half-year), indicating that its commercial strategies and pricing positioning continue to attract consumers.

Severe Pressure on Operating Profitability: The critical issue is overhead , which soared 12.2% in the quarter and 12.5% in the half-year. This increase, well above sales growth, is the direct cause of the decline in Operating Profit (-0.5% in Q2 and -1.9% in H1). The company has mentioned that this is due to heavy investments in technology, e-commerce, and improvements in its value proposition for its employees.

Operating Margin Deterioration: The clearest consequence is the contraction in the operating margin, which fell from 7.8% to 7.2% in the second quarter. This means that for every peso sold, the company's operating profit is lower than the previous year.

Decline in Net Income: The final impact is a significant drop in net income (-9.6% in Q2 and -8.2% in H1). Rising operating expenses, combined with higher financial costs, have eroded the bottom-line profitability for shareholders.

This income statement is the perfect diagnosis of a company in the midst of an aggressive reinvestment phase. It is sacrificing short-term profitability to strengthen its technological infrastructure and future competitiveness. The big question for the Board and the new management will be determining when these investments will begin to generate the efficiencies and leverage necessary to recover and expand profit margins.

The appointment of Caride, a digital expert, was once a logical move toward an omnichannel future, but his departure suggests the pendulum may have swung too far from the present.

The brilliance of digital innovation cannot overshadow the need for excellence in the fundamentals of business: logistics, inventory management, and, above all, a clear value proposition for the customer who enters the store.

The appointment of an operations veteran like Cristian Barrientos to take the helm on an interim basis is not a coincidence; it's a statement of intent: it's time to get back to basics and stabilize the ship.

But to understand the full context of this move, we must rewind the tape. This apparent stumble in execution didn't begin last year. It has its roots in previous strategic decisions, and few are as emblematic as the conversion of Superama to Walmart Express.

From a brand portfolio perspective, the move may have seemed logical on a spreadsheet: unify, simplify, and capitalize on the all-powerful Walmart brand. However, it was a strategic miscalculation that underestimated the value of an intangible asset: the brand equity and loyalty of a specific, highly profitable niche market.

Superama wasn't just a smaller supermarket. It was a destination. For decades, it had cultivated its own identity, associated with a level of quality, service , and product differentiation that attracted a demographic willing to pay a premium for that experience. Its customers weren't necessarily looking for the "always low price," but rather a combination of convenience and differentiation.

However, it seems that, over time, Superama, having transformed into Walmart Express, suffered the same fate as Kodak. It became uncompetitive, and today, some of its stores are undersupplied and suffer from hygiene and cleanliness issues.

By converting Superama to "Walmart Express," it diluted the identity it had earned over the years. It took a brand with personality and wrapped it in a generic uniform. A loyal Superama customer was told that their store was now, in essence, a miniature version of the giant they had perhaps consciously avoided. The result was the loss of that valuable niche, which no longer found in "Express" the attributes that had earned them loyalty.

A premium positioning was sacrificed for operational efficiency that, in light of current margins, does not appear to have offset the loss.

THE COMPETITIVE PROFILE MATRIX, STRATEGIC THINKING AND WALMART

Continuing our analysis, we'll now look at a Competitive Profile Matrix (CPM). This tool will allow us to objectively visualize the relative strengths and weaknesses of players in the high-end self-service segment, quantifying the strategic loss represented by the transition from Superama to Walmart Express.

The matrix is presented below. The Key Success Factors (KSFs) have been selected based on what consumers in this niche value most. The weight assigned to each factor reflects its relative importance in the purchasing decision and customer loyalty.

ANALYSIS STRATEGIC INTERPRETATION

With this competitive profile matrix, the analysis becomes more evident:

Undisputed Leader: City Market (4.50). Its dominance is absolute. It achieves the highest rating (5) in the three most important factors for consumers in this segment: Quality of Perishables, Gourmet Assortment, and Shopping Experience. It has positioned itself as the gold standard in the sector.

The Strategic Collapse: From Superama (3.65) to Walmart Express (2.95). The matrix quantifies the poor strategic decision. The "Superama Legacy" had a strong competitive position (3.65), tied with Selecto Chedraui. However, Walmart Express plummets to 2.95. The key points of the decline are:

Strengths cannibalization: scores on "Gourmet Assortment" (dropped from 4 to 2), "Shopping Experience" (from 3 to 2), and "Customer Service" (from 4 to 2) plummeted. This reflects the loss of the premium value proposition as it is absorbed by Walmart's standard.

The only inherited strength, the 5 rating for "Strategic Location," remains the same, as it occupies the same premises. However, a good location with a weakened value proposition is not enough to compete effectively.

Solid Competitors: Selecto Chedraui (3.65) and Fresko (3.55). Both prove to be very capable challengers who have taken the lead left by Superama.

Selecto Chedraui equals the score of the former Superama, standing out for its strong gourmet offerings and a very well-designed in-store experience.

Fresko is close behind, with a smart strategy focused on the quality of its fresh products and a slightly higher perceived value, giving it a very attractive position.

In conclusion, this format demonstrates that Superama's conversion to Walmart Express was a competitive setback. It diluted its key strengths and removed it from the competition in the premium segment, creating a void that competitors like City Market have brilliantly capitalized on. The lesson is clear: brand synergy cannot be achieved at the expense of destroying the equity and specific positioning that a sub-brand has built over decades.

WALMART LESSONS FOR EVERY SENIOR MANAGER AND STRATEGIC CONSULTANT

From these interconnected events, crucial lessons emerge for any leader, advisor, or consultant:

1️⃣ Never sacrifice your core for novelty.

Digital transformation and innovation are vital, but they must be built on the foundation of a rock-solid core business. A CEO must be able to pilot both planes simultaneously: that of the future and that of the present.

2️⃣The brand portfolio is more than a collection of logos.

Every brand has a pact with a certain type of customer. Breaking that pact in the name of synergy or simplification is a major risk. Not all customers want the same thing, and pretending that they do is the quickest path to mediocrity and lost margins.

3️⃣The true measure of success is in the bottom line of the income statement.

Impressive sales growth can mask serious profitability problems. Senior management's job is to closely examine the quality of that growth and ensure it is sustainable and profitable over the long term.

The Walmart case is a stark reminder that, in the business world, especially in retail, memory is long and brand decisions have profound consequences. Execution is king, and deep customer understanding is king. Ignoring either of these, sooner or later, takes its toll.

Thank you very much for the privilege of your time,

Juan Carlos Erdozáin

Senior Management Advisor

Comments