GENERAL ELECTRIC THE TRUTH BEHIND THE LEGEND

- Juan Carlos Erdozain Rivera, MBA

- 2 days ago

- 9 min read

Did you think you knew General Electric? The story of the giant born from the mind of Thomas Edison is far more complex and fascinating than you imagine. Discover who's really behind the appliances and light bulbs that bear his name and why the recent news that "GE is leaving Mexico" hides a surprising truth about global strategy and new owners. This isn't just the story of a conglomerate; it's a chronicle of reinvention, the power of a brand, and the changing face of the industry.

A recent article in the newspaper El Financiero highlights a significant shift in General Electric's manufacturing strategy. Currently, the majority of the company's production is carried out in the United States.

The announcement regarding the relocation of operations from Mexico to the United States essentially involves a transfer of work to the company's own plants within that country.

This process demonstrates that the change does not represent a radical transformation in overall production volume, but rather an internal redistribution aimed at strengthening General Electric's presence in its domestic market. Therefore, the main impact lies in the increase in work in US factories, without substantially changing the company's overall production structure.

WHAT WAS AND WHAT IS GENERAL ELECTRIC NOW

The origin of General Electric (GE) is intrinsically linked to the figure of the inventor Thomas Alva Edison.

Birth, Founders, and the Era of Thomas Alva Edison

General Electric was created on April 15, 1892, as a result of the merger of two important companies of the time:

Edison General Electric Company was founded in 1890 by Thomas Alva Edison himself, consolidating his various businesses related to the invention and marketing of the incandescent light bulb and other electrical products.

Thomson-Houston Electric Company was the main competitor of General Electric Company, at that time led by Charles A. Coffin.

The merger was a strategy to resolve complex legal disputes over patents that were hindering the development of both companies. Charles A. Coffin, from Thomson-Houston, became the first president of the new General Electric. Although Edison was a key founding figure, he did not lead the merged company.

GE's origins date back directly to the time of Thomas Alva Edison and are a direct consequence of his pioneering work. His company, Edison General Electric Co., was the foundation upon which the conglomerate was built, providing the technology and electric lighting business that revolutionized the world.

Recent Division of the Company

After more than a century as one of the world's largest and most diversified industrial conglomerates, General Electric embarked on a radical restructuring process. The company was divided (spin off) into three independent, public companies, each focused on a specific sector:

GE HealthCare, which focuses on medical technology, was spin off in early 2023.

GE Vernova, which brings together the energy businesses (renewables, gas, and steam), began trading independently on the stock exchange in April 2024.

GE Aerospace is the legal successor company to the former GE and focuses on the aviation sector, primarily the manufacture of aircraft engines.

But what happened to the appliance division? Which operations will be transferred from Mexico to the United States?

The appliance division (refrigerators, stoves, washing machines, etc.) had a different fate and was sold several years before General Electric's recent split into three companies: aviation, healthcare, and energy.

In 2016, General Electric sold its home appliance division to the Chinese multinational company Haier.

This is what happened:

After the sale to Haier, GE made the strategic decision to focus on its high-value industrial businesses (such as aircraft engines and turbines) and divest from its consumer segments. The sale to Haier was completed for approximately $5.4 billion.

Brand use: As part of the agreement, Haier acquired the right to continue using the iconic "GE" brand on its home appliances for a period of 40 years (starting in 2016).

Therefore, today, when you buy a GE brand appliance, you are actually buying a product from "GE Appliances, a Haier company."

Haier Group's chairman and chief executive officer (CEO) is Zhou Yunjie . He succeeded the company's legendary founder, Zhang Ruimin, in 2021.

Haier Group's global headquarters are located in Qingdao, Shandong Province, China .

Kevin Nolan is the president and CEO of GE Appliances, a Haier company . He is the head of the appliance division, which operates primarily in the Americas.

The historic appliance division that was a fixture in so many homes no longer belongs to the same General Electric company that is now known as GE Aerospace. It was one of the first major divisions GE carried out in its long restructuring process, well before the final separation in 2023 and 2024.

AND THE SPOTLIGHTS? WHAT HAPPENED TO THE SPOTLIGHTS?

This is an excellent question that follows the thread of GE's transformation.

Like appliances, General Electric's iconic light bulb and lighting solutions business is no longer owned by GE .

Since 2020, GE's consumer lighting business (the light bulbs we buy for our homes) has been owned by Savant Systems , a leading US company in the smart home sector.

The Fate of the Lighting Business

The sale was divided into two main parts:

GE Lighting (Consumer) is the division that manufactures GE brand light bulbs, Cync, and other home lighting solutions. It was acquired by Savant Systems, Inc. in 2020.

Savant's idea was to integrate GE's lighting expertise with its own home automation technology to create a more complete smart home ecosystem.

Current (Commercial), the division responsible for lighting for commercial and industrial clients (offices, public lighting, etc.) was sold in 2019 to the private equity firm American Industrial Partners (AIP) .

So, when you buy a General Electric light bulb today, the company that manufactured and supports it is Savant Systems . They continue to use the GE name under a long-term licensing agreement, much like Haier does with home appliances.

Is General Electric moving production from Mexico to the US?

Key Takeaway: Which "General Electric"?

First and foremost, remember that the company that makes stoves and refrigerators, GE Appliances , is no longer part of the General Electric (now GE Aerospace) company we were talking about. Since 2016, it has been owned by the Chinese multinational Haier .

So, although the news story uses the name "General Electric" (because the products bear that brand), the decision to relocate production is being made by Haier's management. This is crucial because the motives and strategy are Haier's, not the original GE conglomerate's.

Why Would They Make This Move?

Viewing the decision from a strategic perspective, it seems to me that it responds to several current economic and political trends:

Nearshoring and reshoring: There is a strong global trend for companies to move their production closer to their largest consumer markets. Moving factories from Mexico to the US is a clear example of reshoring . This allows them to have shorter and more resilient supply chains, reduce transportation costs, and respond more quickly to US market demand.

Incentives and Policy in the U.S.: It's very likely that there are tax incentives or U.S. government programs to encourage companies to manufacture locally and create local jobs. Sometimes, political pressure and tariffs on imported products also influence these decisions.

Consolidation and Efficiency: If most of your production is already in the U.S., consolidating the remainder can make your operations more efficient, reduce management costs, and optimize your logistics.

The Impact Mexico Will Have

Obviously, the other side of the coin is the impact on Mexico. A production relocation, however small, means that the investments and jobs associated with that manufacturing line will move to the United States, which is never good news for the affected local economy.

From my perspective, I think this is a very calculated and strategic business decision on the part of Haier , the owner of GE Appliances, to strengthen its manufacturing base in its core market (the US), likely by leveraging incentives and responding to the global reshoring trend.

Although the headline says "General Electric," it's a prime example of how decisions by a new owner (Haier) can change the course of an iconic brand that no longer belongs to its original founder.

From a strategic point of view, is this strategy correct?

From a purely strategic perspective, Haier's (owner of GE Appliances) decision to move production from Mexico to the United States is a logical and potentially very successful strategy for its long-term objectives.

A complete "success" cannot be declared until the results are seen, but the decision aligns perfectly with global trends and seeks to mitigate significant risks. The reasons are:

Supply Chain Resilience: The pandemic and geopolitical tensions have demonstrated how fragile long supply chains can be. Producing in the U.S. to sell in the U.S. (its largest market) reduces dependence on border crossings, long transport journeys, and potential tariffs, making the operation more robust and predictable.

Speed and Proximity to Market: Being closer to the end consumer allows for a faster response to changes in demand, more efficient inventory management ( Just-in-Time model), and a better ability to customize products.

Quality and Brand Control: Centralizing production in domestic (US) plants gives them greater control over quality standards and processes, reinforcing the image of an iconic brand like GE.

Political and Economic Environment: The strategy capitalizes on the "Made in America" environment, taking advantage of potential U.S. government tax incentives and subsidies for local manufacturing, while protecting against political volatility that could affect trade with other countries.

The strategic "disadvantage" is a potential increase in labor costs, but the company has likely calculated that the benefits in logistics, efficiency, risk reduction, and marketing outweigh that cost.

What kind of strategy is this that Haier Group is pursuing?

It is a combination of several well-known business strategies such as:

Reshoring Strategy refers to the practice of returning production and manufacturing back to the company's country of origin or its main market.

Partial Vertical Integration, by having greater direct control over its manufacturing rather than depending on plants in other countries (even if they were its own), strengthens control over its value chain.

Risk Reduction Strategy, the fundamental objective is to reduce exposure to supply chain disruptions, currency fluctuations, and geopolitical issues.

Market Focus Strategy adapts its production structure to serve its most important market, in this case, the North American market, in the most efficient and direct manner.

Is there a way to strategically measure this decision?

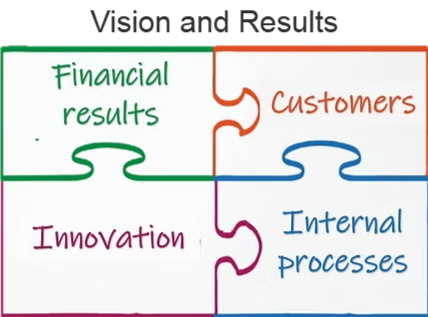

Yes, through the Balanced Scorecard. The success of a strategic decision like this is not measured by opinions, but by hard data through Key Performance Indicators (KPIs) . Some of the most important ones that Haier's board of directors will be monitoring are:

Financial KPIs

Total Cost of Ownership (TCO): Do savings in logistics, tariffs, and inventory offset potential increases in labor costs?

Return on Investment (ROI): How quickly is the investment made to relocate and adapt plants in the U.S. recovered?

Profit Margin: Are profit margins improving on US-made products?

Supply Chain and Operations KPIs

Order Cycle Time: Is the time from when a customer places an order until they receive it reduced?

Inventory Turnover: Are you able to handle less inventory thanks to local production?

On-Time Delivery: Does the percentage of deliveries made on the promised date improve?

Market and Customer KPIs

Market Share: Will they gain more market share in the US market after the change?

Customer Satisfaction Index (NPS - Net Promoter Score): Does it improve brand and quality perception among consumers?

If the numbers in these areas improve over time, the strategy will have been successful. If costs skyrocket and the logistical benefits don't materialize, it will be considered a failure, which is why regular monitoring of the Balanced Scorecard is essential.

PESTEL, A WAY OF LOOKING AT THE BUSINESS ENVIRONMENT LIKE GE APPLIANCES

Quantitative PESTEL of GE Appliances (Haier) in the USA 2025

The analysis and interpretation of PESTEL, mentioned above, is presented below.

Political Analysis

It's moderately favorable. "Made in America" policies and incentives for local manufacturing are a direct opportunity for GE Appliances, which has been shifting production to the U.S. However, uncertainty in trade policies and dependence on imported components pose a latent threat.

Economic Analysis

This is the most critical factor and poses a moderate threat. Although the labor market is solid, persistent inflation and high interest rates reduce purchasing power and make credit for durable goods such as household appliances more expensive. The health of the housing market will be key.

Social Analysis

This presents a significant opportunity. Trends toward sustainability, smart homes, and convenience fit perfectly with GE Appliances' product line. The growing culture of home renovation is also driving demand.

Technological Analysis

This is an area of clear opportunity. The adoption of IoT (Internet of Things), artificial intelligence for more efficient household appliances, and innovation in sustainable materials enable product differentiation and value creation.

Ecological-Environmental Analysis

The regulatory environment and consumer demand are pushing toward sustainability, which is an opportunity for a company that can invest in certifications (such as Energy Star) and develop eco-friendly products. Refrigerant and waste management is a constant but manageable challenge.

Legal Analysis

The legal framework is stable but strict. Strong consumer protection laws and product safety regulations pose a threat if not rigorously managed, but also act as a barrier to entry for lower-quality competitors. Labor laws in the U.S. also impact operating costs.

STRATEGIC CONCLUSION

The PESTEL result shows that the external environment for GE Appliances in the United States is slightly favorable, but with significant challenges that require careful management .

Key Strengths to Exploit (Opportunities)

The company must fully capitalize on social (smart homes, sustainability) and technological (IoT, AI) trends, as these are the areas with the greatest potential and where its investment in innovation can generate a competitive advantage.

Key Risks to Mitigate (Threats)

The economic environment is the primary concern. Pricing strategy, financing options, and cost efficiency will be crucial to navigate consumer sensitivity to inflation and interest rates.

🟡🟢🔵

Comments